Economic Substance Regulation (ESR) was introduced in 2019 as part of the UAE’s commitment to preventing harmful tax practices, such as tax evasion. Endorsed and approved by the Organization for Economic Cooperation and Development (OECD), these regulations ensure that companies have substantial activities and operations in the UAE where they claim to be tax residents.

Here are six critical aspects of ESR in UAE that businesses need to understand:

The Need for ESR in UAE

Economic Substance Regulation (ESR) represents a pivotal step in the UAE’s efforts to fortify its tax framework and align with international standards. Introduced in 2019, ESR is a testament to the UAE’s commitment to combatting harmful tax practices, particularly tax evasion, and fostering transparency in the global financial landscape.

ESR in UAE serves as a comprehensive regulatory framework designed to uphold the principles of economic substance. By requiring companies to demonstrate substantial activities and operations in the jurisdictions where they claim tax residency, these regulations aim to ensure that profits are accurately reported and taxed. ESR in UAE represents a paradigm shift in tax regulation, transcending borders to uphold fairness, transparency, and accountability in international taxation, reaffirming the UAE’s commitment to fostering sustainable economic growth and stability.

ESR Relevant Activities

Economic Substance Regulation in UAE significantly impacts businesses engaged in specific sectors known as “relevant activities.” These activities span a diverse spectrum, encompassing vital sectors such as:

- Banking business

- Insurance

- Investment fund management

- Lease finance business

- Headquarters business

- Shipping business

- Holding company business

- Intellectual property business

- Distribution business

- Service centre business

Companies operating within these sectors must showcase a robust economic footprint in the UAE, regardless of whether they are local entities or branches of foreign companies.

The list includes these particular categories of businesses, ensuring that companies with significant economic activities in the UAE contribute their fair share to the country’s tax revenue and economic development. This approach fosters transparency, fairness, and accountability in the tax system, promoting a level playing field for businesses operating within the UAE’s jurisdiction. Compliance with ESR in UAE is mandatory unless specific exemptions apply.

Exemptions from ESR in UAE

Certain entities are exempt from demonstrating substance. Among the list are:

- Non-UAE tax resident entities

- Investment funds and its underlying SPVs / investment holding entities

- Wholly UAE resident-owned entities engaged solely in domestic transactions.

- A foreign entity’s branch that pays taxes on all its Relevant Income in a foreign jurisdiction.

These exemptions aim to alleviate regulatory burdens for entities with unique operational structures or those contributing primarily to the domestic economy.

However, exempted entities must provide verifiable evidence of their exempt status along with their Notification form to regulatory authorities such as tax residency from a foreign jurisdiction, corporate income tax assessment, fund license/registration, proof of the investment fund status of the investment fund that holds the UAE entities, shareholder register, structure chart, tax return or associated forms.

ESR Compliance Requirements

UAE entities involved in and generating income from a Relevant Activity during a financial year must conduct the associated “Core Income Generating Activities” within the UAE, ensuring they demonstrate that:

- The entity and the Relevant Activity are effectively “directed and managed” from the UAE, which includes conducting board meetings within the UAE, maintaining minutes of these meetings, and having managers and directors based in the UAE.

- The entity maintains a sufficient number of skilled employees, appropriate premises (such as office space), and yearly operational expenses in the UAE that correspond to the nature of the activity.

It is important to note that an entity may engage in multiple Relevant Activities concurrently, necessitating the satisfaction of economic substance requirements for each activity individually. This allows for a diverse range of business operations, each with its own set of ESR criteria.

In summary, entities in the UAE undertaking Relevant Activities must ensure they meet the requirements of ESR in the UAE. Different activities have varying ESR criteria, with some being subject to less stringent requirements than others.

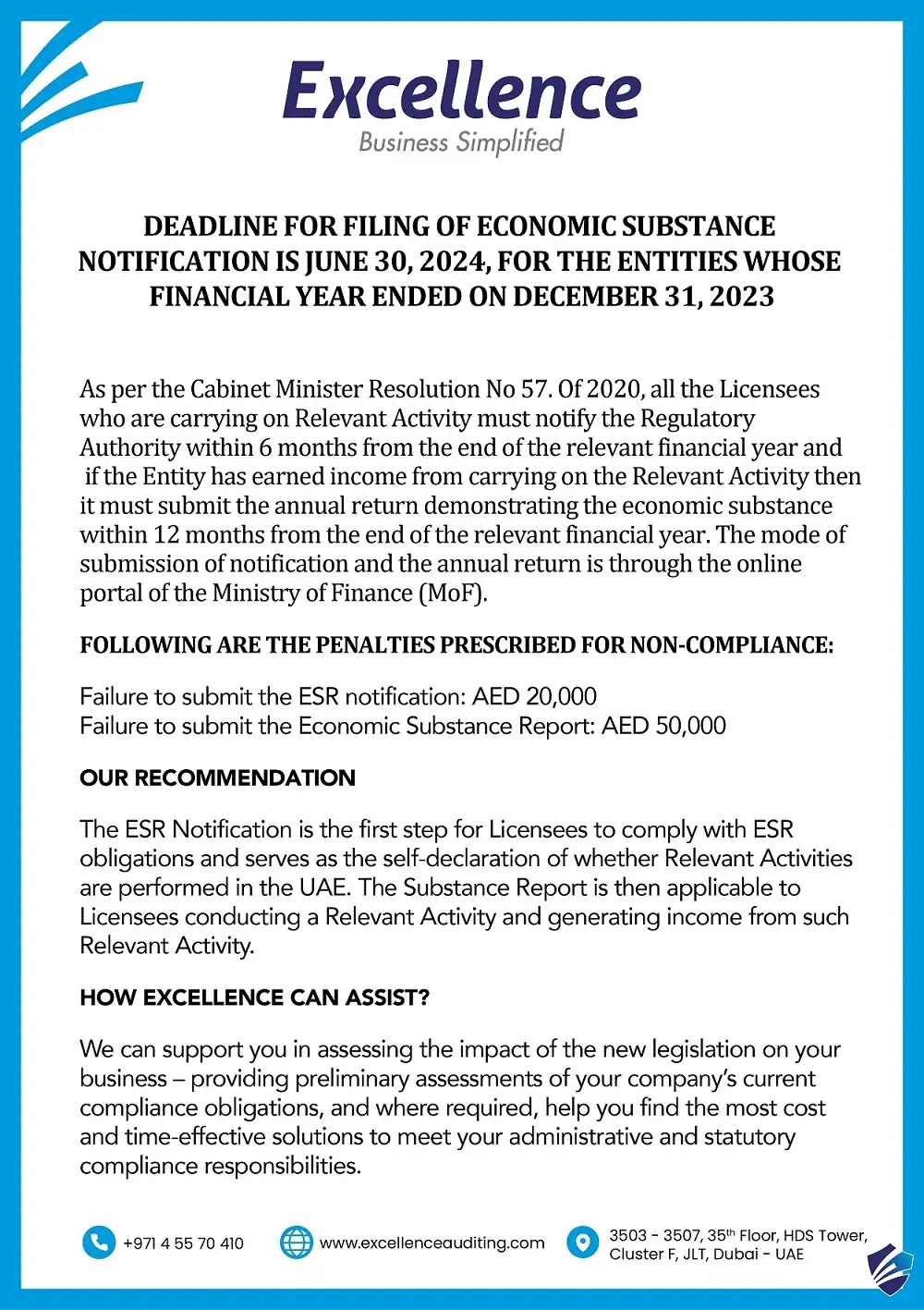

ESR in UAE Reporting Requirements

Entities engaging in relevant activities must adhere to specific requirements and procedures to guarantee compliance with ESR in UAE.

Firstly, they are required to submit an annual notification within six months of their financial year-end. This notification confirms if they conducted any Relevant Activities during the financial year and whether any income from those activities was taxed outside the UAE. Those with exemptions must still notify the Regulatory Authority and provide supporting documents within six months after the relevant financial year concludes. This notification procedure ensures transparency and adherence to regulatory standards.

Furthermore, licensees earning relevant income during a reportable period must meet the economic substance requirements, which include submitting an economic substance report via the MOF Portal within 12 months from the end of the relevant financial year, stating if the licensee has met all the requirements of ESR in UAE.

Penalties for Non-Compliance of ESR in UAE

Entities failing to meet the prescribed requirements under the Economic Substance Regulations (ESR) will incur penalties as outlined below:

- Failure to File Notification: A penalty of 20,000 AED will be imposed.

- Failure to File a Report, Provide Accurate Information, or Demonstrate Economic Substance in the UAE for the Relevant Period: A penalty of 50,000 AED will be levied. Subsequent consecutive failures will escalate to 400,000 AED, and the trade/commercial license cannot be renewed.

These penalties act as a preventive measure to guarantee adherence to regulatory obligations and uphold the integrity of ESR in UAE.

How Excellence Can Support Your Compliance Journey?

Navigating the intricate landscape of ESR in UAE is vital for businesses in the UAE to thrive. At Excellence Auditing, we understand the significance of compliance in mitigating risks and avoiding penalties, so we are dedicated to assisting businesses in meeting these regulatory standards.

Our team of experienced advisors is here to guide you every step of the way. From conducting preliminary assessments of your compliance obligations to delivering customized, cost-effective solutions, we ensure your business stays on the right side of the law.

By partnering with Excellence, you can avoid fines and risks. This allows you to channel your energy into driving business growth while fulfilling statutory requirements. Our team can support and manage the complexities and intricacies of compliance so you can focus on what you do best—running your business excellently.