Navigating Corporate Tax in UAE

Ensuring Compliance on FTA Decision No. 3 for Corporate Tax Registration Timeline

The recent Federal Tax Authority (FTA) Decision No. 3, issued on 22 February 2024, marks a significant development in corporate tax in UAE.

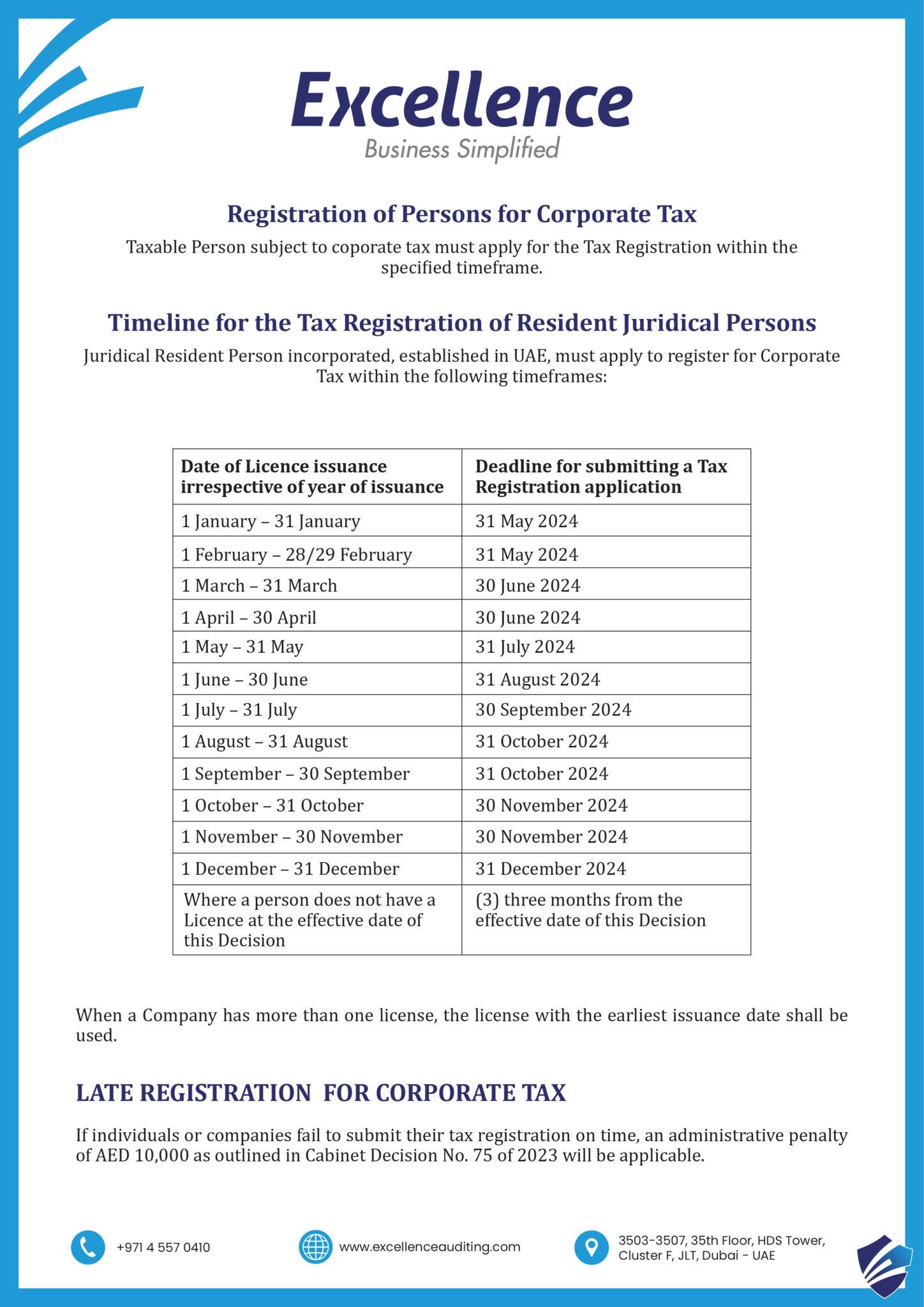

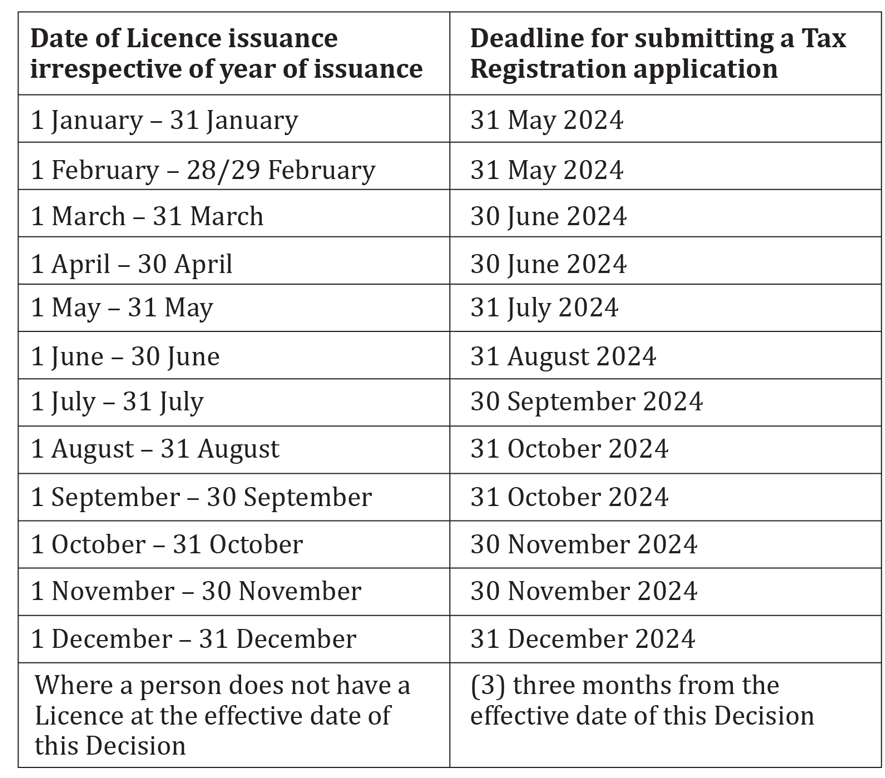

One of the critical aspects highlighted in FTA Decision No. 3 is the specified timelines for Corporate Tax registration, effective from 1 March 2024. The decision underscores the obligation of Resident Persons to submit tax registration applications. The submission timeline is contingent upon the entity’s license issuance date.

As such, Corporate Tax Advisors such as Excellence play pivotal roles in facilitating tax compliance services and ensuring adherence to the stipulated deadlines, thereby fostering a culture of regulatory transparency and fiscal responsibility in the UAE’s corporate landscape.

In line with the above timeline, if a juridical person has more than one license, the license issued with the earliest issuance date shall take precedence.

Tax Registration Applications

Following FTA Decision No. 3, Resident Persons incorporated or recognized after the effective date of the decision must adhere to specific timelines for Tax Registration applications:

1. Resident Persons incorporated or recognized under the UAE’s legislation, including Free Zone entities, must submit their tax registration application within three months of incorporation, establishment, or recognition.

2. For entities incorporated or recognized under foreign jurisdictions but effectively managed and controlled within the UAE, the tax registration application must be submitted within three months from the end of the entity’s financial year.

The above timelines serve as crucial benchmarks for ensuring compliance with regulations of Corporate Tax in UAE.

Timeline for the Tax Registration of Non-Resident Juridical Persons

The timelines below ensure that Non-Resident Juridical Persons comply with the requirement of Corporate Tax in UAE, whether they have a Permanent Establishment or nexus in the UAE, reflecting the regulatory framework’s adaptability to different business circumstances and ensuring adherence to tax obligations.

For Non-Resident Juridical Persons, the timeline for Tax Registration varies based on specific criteria:

1. Non-Resident Persons before the effective date of the Decision:

- If the person possesses a Permanent Establishment in the UAE, the tax registration application must be submitted nine months from the date of the permanent establishment

- If the person has a nexus in the UAE, the tax registration application must be submitted three months from the effective date of the Decision

2. Non-Resident Persons after the effective date of the Decision:

- If the person holds a Permanent Establishment in the UAE, the tax registration application must be submitted six months from the permanent establishment date

- For those with a nexus in the UAE, the tax registration application must be submitted three months from the nexus’s establishment date

Timeline for Tax Registration of Natural Persons

The timeline for Tax Registration of Natural Persons conducting business activities in the UAE is outlined as follows:

- Resident individuals conducting business activities in the UAE during the 2024 Gregorian calendar year or subsequent years, whose total turnover in a Gregorian calendar year exceeds the threshold specified in relevant tax legislation, must submit a tax registration application by 31 March of the subsequent Gregorian calendar year.

- Non-resident individuals conducting business activities in the UAE during the 2024 Gregorian calendar year or subsequent years, whose total turnover derived in a Gregorian calendar year exceeds the threshold specified in relevant tax legislation, must submit a tax registration application three months from the date of meeting the requirements of being subject to tax

Penalties for Non-compliance

Understanding the regulations of corporate tax in UAE is pivotal for businesses. Such compliance fosters regulatory adherence and the nation’s economic growth and development by contributing to its fiscal framework.

Businesses must prioritize adherence to the timelines and requirements stipulated by the authorities for Corporate Tax in UAE. Failure to submit the Tax Registration application within the specified timelines outlined in the regulations may result in significant consequences. In particular, non-compliance may incur an administrative penalty of 10,000 AED, as detailed in Cabinet Decision No. 75 of 2023. This penalty underscores the seriousness of adhering to tax regulations and highlights the importance of timely compliance to avoid financial penalties and legal ramifications. Therefore, businesses must remain vigilant and ensure proactive compliance with the prescribed tax registration procedures to mitigate the risk of penalties and maintain regulatory integrity.

How Excellence can help?

In the ever-evolving business landscape of the UAE, it is essential to stay informed about the latest developments in tax regulations. At Excellence, we understand the significance of staying abreast of regulatory changes and tax requirements to ensure compliance and foster business growth. Our comprehensive suite of tax compliance services meets all the diverse needs of businesses operating in the UAE.

Maintaining compliance with legal obligations is non-negotiable in a dynamic environment where policies undergo constant evolution. At Excellence, we are committed to effectively support businesses and organizations in navigating changing tax regulations. With our team of professional accountants and corporate tax advisors, we offer expertise and guidance to help companies stay current with the latest developments and requirements related to tax registration, ensuring compliance with the regulations of Corporate Tax in UAE.

By partnering with Excellence, businesses can benefit from our proactive approach to compliance, mitigating the risk of unforeseen complications and penalties. Our dedication to Excellence ensures businesses have the knowledge and resources they need to thrive in the UAE’s dynamic business environment.